As 2023 draws to a close and 2024 gets underway, the logistics economy is getting more complicated. Threats of attack by the Houthis prompted shipowners to reroute their vessels via southern Africa. To the west, the Panama Canal is easing pressure, but transits are still limited. Added to this are surcharges associated with longer transit times and new European regulations.

CURRENT SITUATION

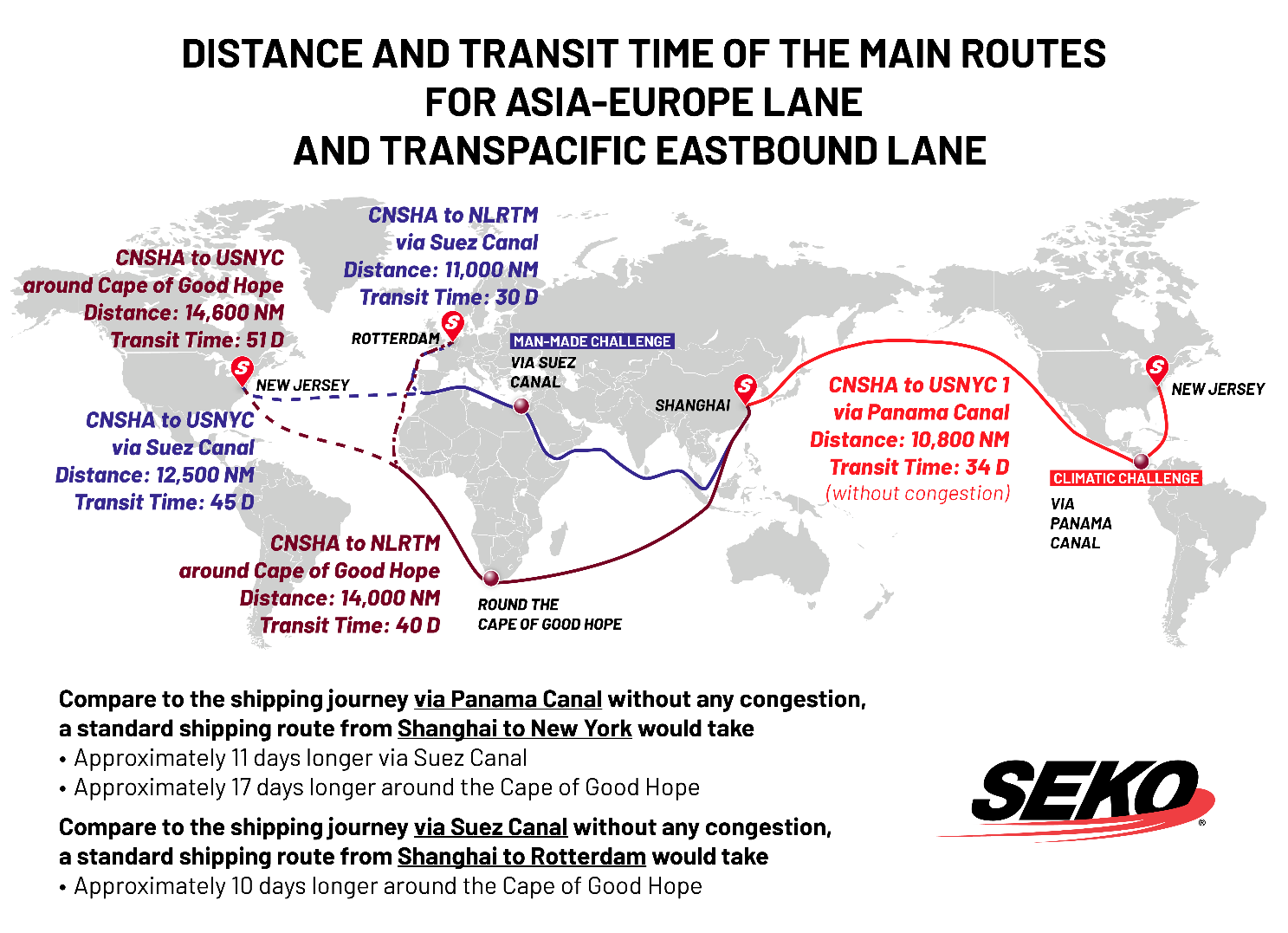

Given the threat to ships transiting the Suez Canal and the severe drought in the Panama Canal, carriers were forced to divert via the Cape of Good Hope, resulting in significant additional transit times and costs.

As of December 24, a record 125 container ships, with a total capacity of 1.77 million TEUs, were using the longer route around Africa instead of the Suez Canal. This number is set to increase as more ships are scheduled to divert.

To address security concerns, the international joint task force launched Operation Prosperity Guardian, which provides security escorts for ships crossing the Red Sea. However, despite these efforts, most of the major container carriers have already diverted much of their capacity around the Cape of Good Hope. Although some vessels have returned to the Suez Canal route under protection (as indicated in Maersk's Vessel Contingency Updates), the impact of the situation remains to be seen.

Given the current scenario, we expect the disruption caused by rerouting to continue through January and February.

It should also be noted that Europe is more dependent on the Suez Canal than other regions, and could therefore experience greater delays. Analysts at UBS have estimated that the Cape of Good Hope route reduces the effective capacity of an Asia-Europe voyage by 25%.

Port authorities anticipate congestion at ports due to updated arrival times and planning requirements, which will lead to disruption.

In addition, interrupted or extended transit times are weighing on global transport capacity, not just in the Red Sea, leading carriers to impose rate increases and war risk surcharges.

According to Freightos, the Red Sea crisis has already led to a 44% increase in fares between China and the Mediterranean.

WHAT NEXT?

The situation in the Red Sea remains complicated, and the effects of global warming on lower water levels in the Panama Canal are likely to be long-lasting. Companies continue to reassess the situation regularly before restoring their services.

In the meantime, the sector faces a number of challenges: higher costs, longer transit times resulting in blank sailing and a reduction in China's export trade, as well as ETS surcharges. As a reminder, as of January 1, 2024, the European ETS (Emissions Trading Scheme) regulation comes into force.

All SEKO BANSARD teams are taking steps to obtain additional SPOT/Premium space and are implementing alternative transport solutions such as SEA/AIR.

Contact your usual contact or sales@bansard.com